Is Arkansas fairly administering sales tax rebates?

By Drew Gazaway

AAC Law Clerk

The burden of sales tax rebates on cities and counties in Arkansas is extremely costly and only continues to grow. This adversely impairs counties’ ability to fund their own  programs and projects. Arkansas is the only state that puts the burden of rebate costs solely on the cities’ and counties’ sales and use taxes with no contribution or participation from the state sales or use taxes.

programs and projects. Arkansas is the only state that puts the burden of rebate costs solely on the cities’ and counties’ sales and use taxes with no contribution or participation from the state sales or use taxes.

In the state of Arkansas, the Arkansas Department of Finance and Administration (DFA) oversees the administration of Arkansas sales and use tax laws. The state sales and use tax rates each are set at 6.5 percent. The state sales tax is 6.5 percent of all gross receipts from sales of tangible property and select services.

Each county and city has the option to levy its own county sales tax. As a result, the local sales tax rate varies in counties and cities across the state. The average local sales tax rate is 2.6 percent. The combined state and local sales tax rate is around 9.5 percent, which is high compared to most other states in the country.

A major point to be made is that our state law directs the counties and cities to provide rebates to taxpayers even though by far most of the sales and use tax burden is due to the state sales tax or state use tax. Many neighboring states have similar rates or higher for combined state and local sales tax. The mid-south region has some of the highest sales tax rates in the entire country. This article will examine the laws of other states. Our state law policy may lead to higher local sales tax rates.

In 2008, Arkansas’ state and local sales and use tax laws were changed to comply with the Streamlined Sales and Use Tax Agreement (SSUTA). The SSUTA is a joint effort by several states to make the sales and use tax collection and administration by states and local governments more uniform by minimizing costs and administrative burdens on the businesses or retailers that collect the sales tax. The SSUTA repealed all caps on local taxes as a result, and after Jan. 1, 2008, no local tax caps on single transactions apply except for the sale of motor vehicles for certain uses. Sellers must collect state, city, and county taxes at the full rate for all other sales.

However, despite the absence of caps on some sales and use taxes, certain businesses and entities can claim a rebate for any eligible business purchase over $2,500 in local sales and use taxes. Qualified purchases include purchases for business expense deductions, depreciation deductions, purchases by exempt organizations, and by a state, county, or municipality and more under A.C.A § 26-52-523, which was adopted in 2007. The sales and use taxes refunded to the purchasers for this rebate comes only from either cities or counties, while the state sales and use tax does not share in the burden. Other statutes allow contractors a rebate for any tangible personal property that becomes a “recognizable part of a completed structure or improvement” to real property. This is provided that the purchase was made before any additional levies of “additional state, city, or county gross receipts tax or compensating use tax,” according to A.C.A. §§ 26-53-138, 26-52-427, both adopted in 2007.

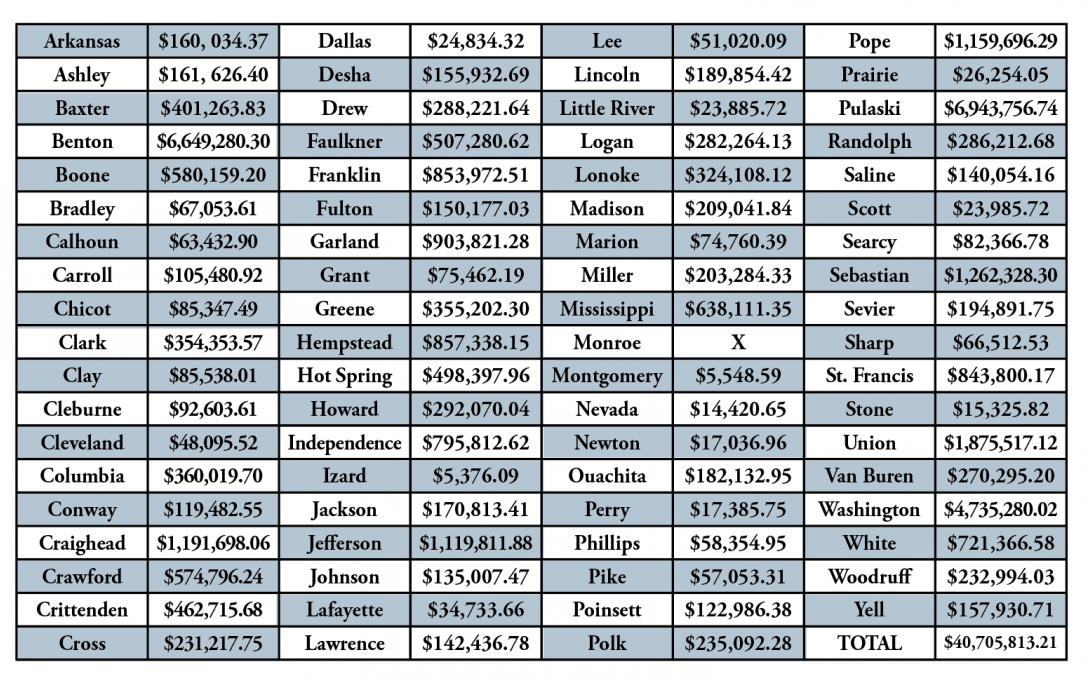

County judges and treasurers across the state are faced with large amounts of local revenues being intercepted prior to allocation by the DFA to go to pay substantial rebates each year. Below is a chart reflecting the annual rebates incurred by counties during 2023.

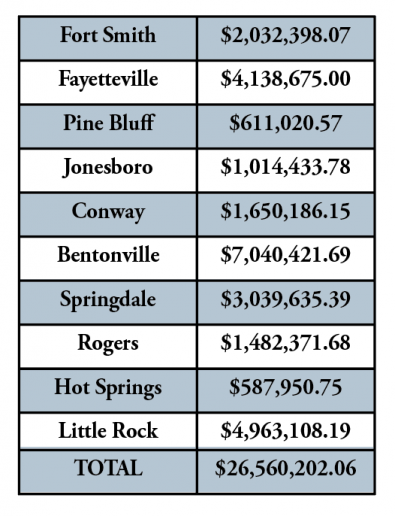

The total sum of rebates by counties during 2023 was $40,705,813.21. Also, see the chart below referencing the rebates during 2023 by the 10 most populated cities in Arkansas:

The total sum of rebates by counties during 2023 was $40,705,813.21. Also, see the chart below referencing the rebates during 2023 by the 10 most populated cities in Arkansas:

For the entire year of 2023, those specific cities alone paid rebates equal to $26,560,202.06. Again, the relevant statutes A.C.A. §§ 26-52-427, A.C.A. 26-53-138, and A.C.A. 26-52-523 do not call for the state sales and use tax revenues to be involved, to participate or to contribute to any part of the rebates.

For the entire year of 2023, those specific cities alone paid rebates equal to $26,560,202.06. Again, the relevant statutes A.C.A. §§ 26-52-427, A.C.A. 26-53-138, and A.C.A. 26-52-523 do not call for the state sales and use tax revenues to be involved, to participate or to contribute to any part of the rebates.

If the rebates included participation of the state sales and use tax, then the local sales taxes adopted could be used for projects such as building, adding to, or operating a jail or courthouse.

“[E]very one of our tax-payer dollars are critical to important aspects of the county such as infrastructure and public safety. The county’s growth has become an increasingly large challenge for us, and overall, we want a much more equitable relationship with the state and with this issue and many others,” said Washington County Judge Deakins.

Other judges have had the same problem.

“The state does not participate in this process, and if it did, it would take a large burden off the county, especially for public safety purposes because of the county’s continuing growth. The state should participate in the process just as much if not greater than the counties,” said Garland County Judge Darryl Mahoney said.

Craighead County, is facing similar issues.

“The $2,500 cap was a significantly larger number years ago than it is today. These rebates are disproportionately affecting cities and counties,” said Craighead County Judge Marvin Day.

Our counties each have annual budgets. The time for filing a rebate is one year. Our counties and local taxing units have difficulty managing the shortfalls in managing large rebates in the midst of a current budget.

Regarding the effects of these rebates on county budgets, Van Buren County Judge Dale James said, “When the budget is already set, and the budget revolves around a fixed number, the rebate can completely consume the 10 percent owed to the counties.”

This is because the county can only appropriate 90 percent.

“This leaves zero breathing room in our budgets. The county at one point had to go through a period of hiring freeze and layoffs to make ends meet,” Judge James added.

Senate Bill 528 of the 2021 Regular Session, Act 776, sponsored by Sen. Bill Sample, amended A.C.A. § 26-18-303 for the disclosure of information on certain credits and rebates of sales and use tax to affected local governments under relevant statutes A.C.A. §§ 26-52-427, 26-52-523, and 26-58-138. This information has been made available through a national database known as the North American Industry Classification System (NAICS). This assists in foreseeing upcoming rebates but does not completely mitigate the adverse impact of claims for large rebates from counties and their ability to operate under a preexisting or current annual budget.

“The amount taken from the counties in rebates is a large number, but it is difficult to tell exactly what will be taken from the county. The transparency bill did help, but it is still difficult to drill down exactly what the county owes,” Judge Mahoney said when he was asked about the adverse impact of large rebates to a county budget and operations.

“The state should participate, as the rebates affect our county particularly because the county’s revenue is tourist driven. When money is taken from the general fund for this purpose, it hurts the county,” he added.

NAICS is used to classify businesses for the administration and collection of sales and use taxes. The DFA provides a “Local Distribution by NAICS Report” that shows certain monthly tax collection statistics and information. This information includes any local tax rebates issued for each Arkansas city or county that levies such local sales and use taxes. According to NAICS reports, the total amount of rebates paid by county sales tax was about $40 million for the year 2023 alone. For cities, the total is likely much higher, as the rebates just from December 2023 from 10 of the largest cities in the state totaled $2,530,773.59 and for the year 2023 was $26,560,202.06. Overall, the net combined sales and use tax paid in 2023, was $900,493,435.22. Of that aggregate sum of rebates statewide, 81 percent of the cost of the rebate was for sales tax alone, with use tax making up just around 19 percent.

Other states do not have this problem. Arkansas sits in a region of the country where the total state and local sales tax is high. The states with the highest combined state and local sales tax were Louisiana at 9.5 percent, Alabama at 9.25 percent, and Oklahoma at 8.98 percent. However, despite neighboring states having a similarly high rate of sales tax, none of the neighboring states in the region impose rebate payments solely on cities and counties with no participation from the state.

“This is not solely an equity issue but also a competitiveness issue,” said Benton County Judge Barry Moehring. “Arkansas’ growing counties with robust economies are penalized by this issue compared to neighboring states and counties, which ultimately will inhibit growth and hurt the state overall. This is really an opportunity for the state to get innovative on how to provide relief to counties that help the state the most with economic growth.”

Alabama, for example, has tourism rebates that are a “combination of state and local retail sales tax, state and local lodging taxes, and any other taxes.” [Ala. Code § 40-18-73 (West)]. In Alabama, the state shares in the payments of rebates to companies. Under Alabama’s Brownfield Development Tax Abatement Act, Alabama also rebates the gross proceeds of a sale of tangible property that could be incorporated into a brownfield. [Ala. Code § 40-9C-7 (West)]. Importantly, though Alabama counties can choose whether to participate in the rebate program, Arkansas counties are given no choice.

Another neighboring state, Louisiana, has “enterprise zone incentives.” In Louisiana, the board responsible for enterprise zones can contract for up to five years to provide for the rebate of sales and use tax levied by the state. (La. Stat. Ann. § 51:1787). As in Alabama, these rebates are limited in several ways. Some of these limitations include time limits, the designation of only certain areas to be included in the rebate, and the fact that cities and counties must first approve the rebate. In addition, the state shares in the burden.

Alabama, Louisiana, and other nearby states simply do not have laws that solely burden the local governments with rebates. Where these states do burden local governments with rebate payments, the state always shares in the burden. Where the state does not share in the burden, the municipality or county will always have the option to levy or not levy the rebate. In Texas, for example, a rebate statute for the state’s Qualified Hotel Project states, “… [a] governmental body, including a municipality, county, or political subdivision, may agree to rebate, refund, or pay eligible tax proceeds to the owner of a qualified hotel project at which the eligible taxable proceeds were generated …” [Tex. Gov’t Code Ann. § 2303.5055 (Vernon)].

South Carolina has a very similar statute to Arkansas regarding construction contracts. However, it provides an exemption, not a rebate. The South Carolina statute states that the gross proceeds are exempt from the local sales and use tax, but there are no rebates involved. Act 181 of 2007 rewrote Arkansas’ statute to provide rebates rather than exemptions.

Unlike Arkansas’ statute, South Carolina exempts certain contracts from paying sales tax under that contract but does not require the cities and counties to pay a rebate. Other states, such as Oregon, have set up certain funds to pay out rebates, such as the Residential Heat Pump Fund that provides rebates for any purchase or installation of certain heat pumps to a home. [Or. Rev. Stat. Ann. § Ch. 86, § 19 (West)]. Overall, for the payment of rebates, no other states burden cities and counties alone — the state participates and shares in the rebate. In fact, in some states, the state shares the entire burden for construction contracts, as in Iowa. [Iowa Code Ann. § 423.4 (West)]. The County Judges Association of Arkansas (CJAA) has voted to reach out to the Governor and Arkansas General Assembly to conduct a study and consider legislation to seek inclusion of the state sales and use tax in rebates offered and provided under Arkansas law.

Because the local burden to pay the rebates is so heavy, there must be action taken to reduce the city or county’s exclusive responsibility to pay. One way the state could lessen the burden would be to participate in tax rebates for monthly invoices for electricity exceeding $2,500. This would help even out the burden cities and counties face today in paying large amounts in rebates based upon monthly electricity invoices that could be shared by the state.

Crypto mining data centers would necessarily use over $2,500 worth of electricity every month. The White House has provided a report that discusses the energy implications of crypto mining data centers, which states that cryptocurrency data centers use around 120 and 240 billion kilowatt-hours per year, which exceeds the electricity use of many single countries. [OSTP (2022). Climate and Energy Implications of Crypto-Assets in the United States. White House Office of Science and Technology Policy. Washington, D.C. Sept. 8, 2022, page 5.] Crypto mining data centers consume about 0.9 percent to 1.7 percent of all total electricity usage in the United States, according to the report. In addition, the report states, “[t]his range of electricity usage is similar to all home computers or all residential lighting in the United States.”

In Arkansas, crypto mining data centers use enough power for 7,000 or 8,000 homes but only employ less than five people. And, unlike other industries that use significant amounts of energy, they are not major contributors to Arkansas’ gross domestic product (GDP). Arkansas would benefit from properly allocating the burden of the tax rebates for these large data mining operations, as they expend tremendous amounts of energy and create very few job opportunities.

Overall, Arkansas is the only state that burdens the cities and counties alone with rebates, and it costs localities a significant amount of money each year. The state should share in the burden of these rebates in some shape or form as other states have done. Participation by the state on the rebates from monthly electricity invoices is a solution to study and consider. An economic impact study may be required. Overall, a study and consideration of solutions would be helpful in combatting the county and city burden of rebates